The UK’s Competition and Markets Authority (CMA) has cleared the Three/Vodafone merger, subject to legally binding commitments. It is expected to formally complete in the first half of 2025.

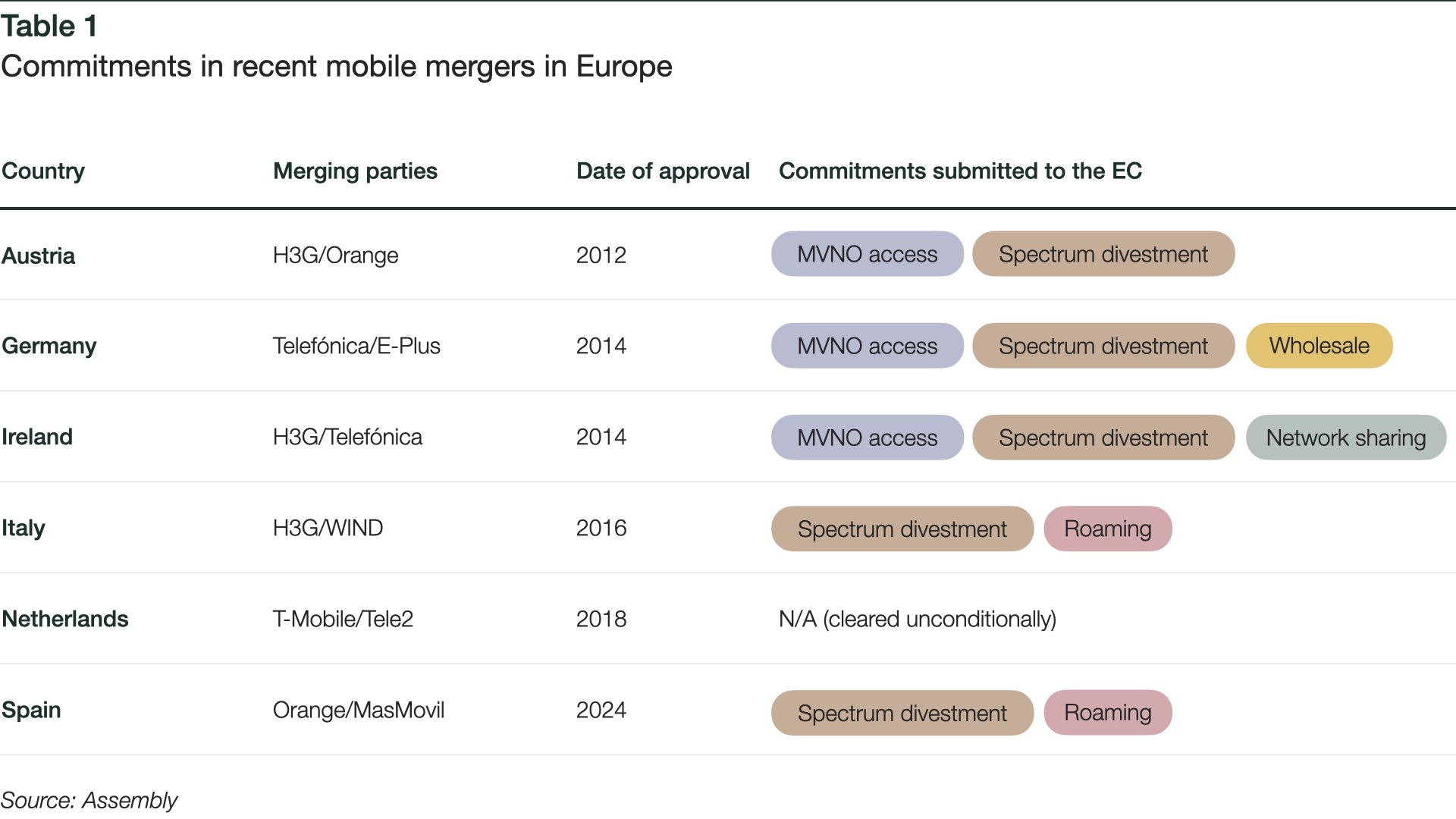

“Since 2010, Europe has seen 10 attempts at in-market mobile consolidation, with the majority (seven) approved with commitments (often structural that undermined the rationale for the merger), one cleared unconditionally, one blocked and one abandoned. At the start of this process, the clearance of Three/Vodafone based on behavioural remedies would’ve appeared an unlikely route for the CMA to take, but one that over time has made sense. Approval with a structural remedy that created a new fourth mobile network operator would not have – pretty much everyone agreed on that (Italy’s expected reconsolidation points to why). The CMA itself has become more comfortable with this merger as its robust investigation has gone on, utilising expert input from industry, and crucially Ofcom (more on that later), to understand the likely impacts.

“Be in no doubt – while largely a formality at this point, today’s final report, and green lighting of the merger, sets the wheels in motion for a transformation of the UK’s mobile market, and ultimately the experience for consumers. There is still a chance Sky may seek to challenge the decision, but a successful appeal to the CAT would be hard-fought, expensive and face a high bar. We expect positive implications overall, not only for investment in, and the quality of, networks (including standalone 5G), but also for the wholesale customers and consumers and businesses that rely on them.

“The remedies package and headline investment commitment mean that the CMA’s work in this case is not quite over – and for Ofcom it’s just getting started. While it will be incumbent on a combined Three/Vodafone to invest and implement the requisite customer protections, Ofcom will play a vital (and new) role with respect to oversight and enforcement. Importantly, the regulator seems emboldened to assume these responsibilities. Its monitoring will need to be carried out in an agile way as possible to ensure the merged entity is living up to expectations and to minimise any risk of circumvention or market distortions that some have warned about.”

To speak to an analyst for additional comment contact:

+44 20 3026 2700

press@assemblyresearch.co.uk